Learn how crowdfunding works and how can it help your business in this guide.

What Is Crowdfunding

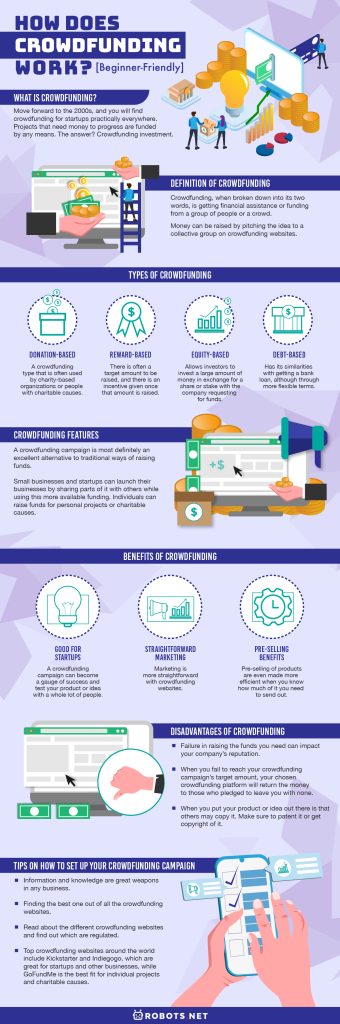

Many businesses may have gone through the traditional ways of acquiring money to start, but the process was a lot more complicated and slightly soul-crushing. Back then, you can end up being rejected by the bank for a loan and relying heavily on personal debts to finance a startup. Move forward to the 2000s, and you will find crowdfunding for startups practically everywhere. Simple ideas that would ordinarily have been rejected by banks and investors are making waves and finding success. Projects that need money to progress are funded by any means. The answer? Crowdfunding investment. If you’ve heard of GoFundMe, then you already may have an excellent idea about what crowdfunding is all about. To best understand what options you have ahead of you and how crowdfunding works, let us first dive into the definition of crowdfunding.

Definition of Crowdfunding

Crowdfunding, when broken down into its two words, is getting financial assistance or funding from a group of people or a crowd. Money can be raised by pitching the idea to a collective group on crowdfunding websites. The crowdfunding investment raised through these sites starts with small amounts from different people who like the business idea. These small amounts of money from many people can become significant when put all together. Crowdfunding websites are quite popular in connecting people who want to become entrepreneurs and investors. This idea of connecting people and giving them the means to turn a business dream into a reality has been taken on by more than 600 crowdfunding websites.

Projections for Crowdfunding

Crowdfunding has blazed a trail in the world of investment and startups. The projection is that by the year 2030, the crowdfunding business will have grown to $300 billion. Not bad for something that started as a challenge to the status quo in 1997. As part of defining crowdfunding, we have to look back to its history. It all began when the rock band, Marillion, needed to raise money to make a U.S. tour possible. Fans were more than eager to make this possible, and $60,000 was raised along with the idea and strategies of crowdsourcing. Through crowdsourcing investment, businesses and startups now have more democratic means of growing without the weight of substantial loan interest. Because of the great opportunity provided, crowdfunding gained popularity and went mainstream through different crowdsourcing websites. Now even individuals can start their businesses or raise funds for a non-profit project by appealing to people all over the world. Crowdsourcing websites like Gofundme.com have even provided individuals with fundraising opportunities for personal endeavors.

Types of Crowdfunding

Knowing what kind of funding you need will tell you what type of crowdfunding you will need to pursue and which crowdfunding site will be able to help. Four basic types of crowdsourcing exist that will be discussed here. You’ll learn how crowdfunding works depending on the type and how it can help you.

Donation-Based

The first would be the donation-based one. This is a crowdfunding type that is often used by charity-based organizations or people with charitable causes. Money given to this does not come with an incentive or is simply given without anything in return. This is most definitely not a crowdfunding investment source, but a popular one nonetheless. Crowdfunding websites like GoFundMe are examples of these.

Reward-Based

Another popular crowdfunding type is the reward-based one. Small businesses and even non-profit organizations usually go for reward-based crowdfunding. There is often a target amount to be raised, and there is an incentive given once that amount is raised. Hence the term “reward-based.” Indiegogo and Kickstarter are popular crowdfunding websites using this. Beeline is a company that used reward-based crowdfunding to finance its newest motorbike navigation device on Kickstarter, a crowdfunding website. It provided different rewards in the form of a necessary device for different amounts given. This ingenious method quickly made Beeline a success story because the range of rewards was quite appealing. The higher the amount, the bigger the reward package.

Equity-Based

The third type of crowdfunding is equity crowdfunding. This type allows investors to invest a large amount of money in exchange for a share or stake with the company requesting for funds. This share, stake, or percentage is the “equity” in this type of funding. Equity-based crowdfunding is widely popular for crowdfunding for startups, businesses that need the money to launch. However, with this kind of funding, there are disadvantages, such as losing part of the investment returns. Becoming part-owner of a company also means sharing not just the rewards, but also the risks. An example of a company that successfully utilized equity crowdfunding is Dubuc Motors, an electric sports car company. The company raised more than six million dollars to grow its operations. Its crowdfunding campaign was also used to introduce a new and fast electric car. It was the first electric car company to use equity-based crowdfunding.

Debt-Based

Debt-based crowdfunding has its similarities with getting a bank loan, although through more flexible terms. A loan exists, and interest also exists. This time, though, it is a large group of people who borrow money and expect it to be paid back with interest. The lenders do not expect any kind of incentive with this kind of crowdfunding campaign. Small businesses and also startups can benefit from this kind of crowdfunding as an alternative to bank financing. Debt-based crowdfunding is also known as peer-to-peer crowdfunding. Websites that offer these are Prosper and Lending Club. Kiva is one that allows crowdfunding for startups to empower people. Some people have asked, “How does crowdfunding work for real estate?” This is another way to earn money because a person is allowed to invest in real estate. Imagine putting money into a real estate venture you believe in without the presence of real estate agents, mortgage brokers, or contractors. This type of crowdfunding investment falls under securities crowdfunding, which is also equity crowdfunding.

Crowdfunding Features

A crowdfunding campaign is most definitely an excellent alternative to traditional ways of raising funds. Small businesses and startups can launch their businesses by sharing parts of it with others while using this more available funding. Individuals can raise funds for personal projects or charitable causes without the pressures of giving back incentives or promising results. Entrepreneurs can avail of loans more quickly through their peers. If you’re interested in learning how crowdfunding works, you should check out its features. Crowdfunding websites allow individuals to launch crowdfunding campaigns that give more decision-making power to the people. An entrepreneur or a business company can find success by appealing to more people for financial assistance, allowing them more freedom to pursue their goals for growth. It is essential to know that some crowdfunding campaigns are taxable. Any crowdfunding done to raise money for a business venture or business project is taxable. This can be subject to income tax. Crowdfunding websites provide forms for these activities. A gift tax applies to crowdfunding campaigns that raise more than $15,000 by individuals who have raised money, not for business purposes. On the other hand, crowdfunding campaigns that are more of charitable donations are not subjected to any tax. This is especially true if a non-profit organization or charitable foundation did the crowdfunding campaign. A crowdfunding campaign raises a buzz on the world wide web, and crowdfunding websites create more opportunities by the day. Crowdfunding projects are highly popular and provide more accessible ways to raise capital or get donations. According to the numbers, about 70% of crowdfunding campaigns exceeded their goals, and $34 billion has been raised through crowdfunding.

Benefits of Crowdfunding

Now that you have seen what a crowdfunding campaign can achieve, you may want to know more about its benefits. Many could entice you to start your crowdfunding campaign, but it is best to know all sides of the crowdfunding trend. Continue reading below to see how crowdfunding works for businesses and how it can boost yours now.

Good for Startups

If you are a startup company or an entrepreneur with what you believe is a great product or idea, going through a crowdfunding website to fund it will serve more than one purpose. A crowdfunding campaign can become a gauge of success and test your product or idea with a whole lot of people. It somehow serves as a validation of how good your product or idea is. Crowdfunding websites allow people to ask you about your product or idea. They can explore it more and even give you valuable insights because you cannot know everything. In other words, crowdfunding allows you to improve your business product or idea further. Billions of dollars have been spent on marketing research all around the world. Through your crowdfunding campaign, which allows you to study your product or idea through people who may support you, you can save on this cost. By going through a crowdfunding campaign, you can generate more publicity about your company, your innovative product, or your awesome idea! You can get the attention you need to jumpstart things and launch it when you have raised the right amount. if you are planning your own startup, why not try to apply what you’ve learned from our how does crowdfunding work? guide?

Straightforward Marketing

Marketing is more straightforward with crowdfunding websites. Indiegogo and Kickstarter combined received more than 600,000 unique visitors monthly. With this kind of marketing success, more awareness of the product or company is created, bringing in more customers without more costs. When a lot of people backs your crowdfunding campaign, they can even be the one who will share your company’s story with others. Imagine all the attention it can draw with people posting and sharing on social media platforms. By having a more personal connection with your investors with your equity crowdfunding, you can create a lasting relationship making them your advocates and even the most loyal of customers in the long run.

Pre-Selling Benefits

Pre-selling of products are even made more efficient when you know how much of it you need to send out. This reduces financial risks caused by a supply surplus. You may also have the options of upselling and cross-selling, and these are done quickly through a crowdfunding platform. You can persuade people to buy an upgraded version of the product (upsell) or complementary products (cross-sell).

Disadvantages Of Crowdfunding

There are always two sides to a story, and if there are advantages, there are also disadvantages. If you are an enterprise or a startup and use a crowdfunding campaign to launch your business, its failure in raising the funds you need can impact your company’s reputation. When a product or idea is promising, it gets attention. When it is not, it still gets attention, especially with a crowdfunding campaign. This could hurt your company’s future or impact its momentum. That is why it is best to carefully consider your company or product branding before jumping in on the crowdfunding bandwagon When you fail to reach your crowdfunding campaign’s target amount, your chosen crowdfunding platform will return the money to those who pledged to leave you with none. There are also platform fees to consider, and these range from five to 10 percent. Another disadvantage when you put your product or idea out there is that others may copy it. Make sure to patent it or get copyright of it. Even so, there will still be existing copycats. Not only is it important to know how crowdfunding works but you’ll also have to research its possible drawbacks.

You and Your Crowdfunding Investment

If you decide to invest in equity crowdfunding, you should be well aware of the risks you are taking. It is quite possible for the company that you invested in to fail later on. When it does, you cannot expect to receive a return of investment, so it is best that you only invest money that you can spare. There is also the possibility that your share in the business will not increase in value. Remember that the returns are not always guaranteed. It is also possible that your share may not receive a percentage of the profits if the company does not prosper. Many things can affect a business or a startup during its existence. You may lose interest and decide to sell your shares. Often, shares are not listed, and you will find selling your share difficult if this is the case. This is in stark contrast with large companies that are listed in the stock market. Last but not least, crowdfunding websites can close down, and this is trouble, primarily when your crowdfunding investment has not been invested in the business before the site closed. Business is always a risk, and you can do so only with money that you can gamble with and with the right information.

Tips on How to Use Crowdfunding for Investment

As mentioned earlier, you should only invest money that you think you can lose and not money that you depend on. Set aside about 10% of this available money for a year’s worth. Take your time learning about the crowdfunding website and business by checking with the Financial Services Register. Take note that this does not regulate reward-based crowdfunding websites. Use your crowdfunding investment to offset some of your tax bills and make sure that your profits are tax-free. This is possible when you invest in small companies. Know more about the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS).

Tips on How to Set Up Your Crowdfunding Campaign

Information and knowledge are great weapons in any business. Once you have studied and understood the risks of a crowdfunding campaign, it is time to get down to business. You have already figured out what type of crowdfunding you need to do, and finding the best one out of all the crowdfunding websites is next. Your business is ready to grow, and all you need is the right platform to jump off of. There are many crowdfunding platforms, and North America alone has more than 375. Read about the different crowdfunding websites and find out which are regulated. Your business will have a specific crowdfunding website to work with, and there are many to choose from. Top crowdfunding websites around the world include Kickstarter and Indiegogo, which are great for startups and other businesses, while GoFundMe is the best fit for individual projects and charitable causes. Patreon, meanwhile, is a preferred platform for artists and content creators. If your business product is a good one and you believe it can serve well, opt for reward-based crowdfunding. Offering rewards and incentives are always a great way of enticing people, especially small-time investors. Many offer different levels of investments because options always give investors a more secure feeling because of the freedom to choose. And with that, your question of “how does crowdfunding work?” has been answered. If you are curious to know more, you can check out our list of the top fintech trends. Also, why not read more Fintech articles by exploring our website today?